On the cusp of rate cuts

London property recap: 24 October 2025

An unexpectedly low inflation reading in the US fuelled (yet) another State-side stock market rally on Friday.

But our own inflation surprise in the UK had already perked-up London-listed property stocks earlier in the week:

These are spiky single day gains on the back of Wednesday’s inflation report. It had CPI inflation holding steady at 3.8% for the third month in a row.

Food and drink prices edged down, apparently. (I guess I’m buying the wrong food and drink.)

Housebuilders are certainly crying out for any good news. And while REITs are off their lows, here too would-be investors probably need more reason to get excited. Low rates would supply that.

The market now seems to be betting on a Bank of England rate cut in December. Will inflation have begun to dip by then? Who knows – it’s confounded pundits for years.

Arguably the best scenario for REITs would be falling rates coupled with slightly above-target inflation. Lower rates would ease financing costs and stoke animal spirits. Meanwhile ongoing slightly hot inflation would erode debts and inflate asset values, and keep a continued lid on new supply given the higher costs of construction.

Other property-related companies such as the omnipresent London agent Foxtons – which reported tough going in its sales division that same Wednesday – just want the Budget done and for the residential market to get going again.

Great rate expectations indeed.

The two Robs on the Property Podcast reckon developers are unusually keen to do deals right now. That’s their business so they should know, albeit they’re mostly active in the North. But the same must surely be true in London given all the dire news stories I’ve been featuring here, not least below. And this new 756 sq ft two-bed, two bathroom flat in Clapham Junction has had £40,000 knocked off its list price in just three weeks! It’s now priced at £710,000 but surely any final number would start with a six in this climate. (I believe it’s off-plan, going on the pics and this Savills overview, which has smaller flats at cheaper prices) – via Rightmove

The links

Shortcuts for the discerning property fanatic.

News

Just 26 new build homes were sold in London in June, says Land Registry – Standard

UK housing market losing momentum ahead of the Budget, says Rightmove – Reuters

London flat prices slump as market gets ‘reshaped’ – City AM

Ministers confirm plans to reduce London’s affordable housing quotas – Guardian

Has the Elizabeth Line led to a rise in rental prices? – BBC

Property taxes send UK to ‘second-bottom’ of global rankings – City AM

Businesses run snail farms out of London offices to avoid £300K tax bills – Daily Mail

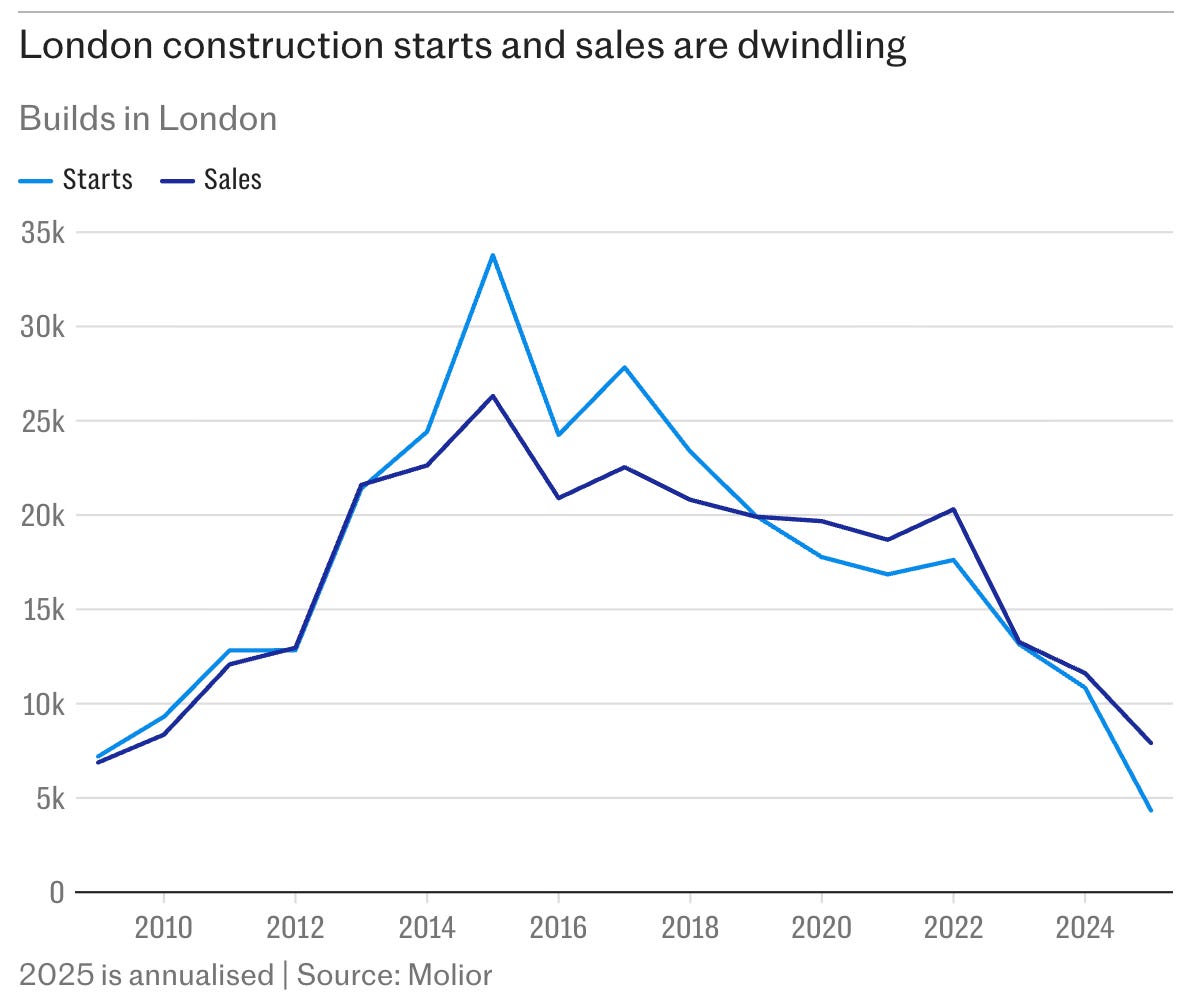

Why can’t London build housing? – City AM

Developers abandon new-builds as London housebuilding collapses [£] – Telegraph

Mortgages, moving, and other money matters

HSBC and Barclays cut mortgage rates as inflation stalls - This Is Money

Taking unsold homes off market may improve sales prospects – Property Industry Eye

Could property tax reform take the fun out of dinner party chat? [£] – FT

Find more investing and money insights at our sister site Monevator

The investing angle

Demand for fixer-uppers soars as investors pile in – Landlord Today

National Insurance on rental income could give edge to older landlords – Property 118

Should landlords fix now or get a tracker mortgage? - This Is Money

The new rules of being a UK landlord [£] – Bloomberg

Government internal spat over landlord EPC cost cap revealed - The Negotiator

Good bones

How to decorate a perfect guest bedroom – House & Garden

“Your garden has a house”: a garden designer’s South London renovation – Standard

This stylishly restored Georgian town house leans on mid-century pieces – Ideal Home

Interior designers share the best high street homeware to shop now – Independent

A very fancy house revamp in Queen’s Park – House & Garden

Good taste and your taste are not always the same thing – FT

Your great outdoors

Plant wild tulips for a meadowy garden look come spring – Guardian

The 20 best plants for nature-friendly winter seedheads – The Middle-sized Garden

Property picks, home…

Like the denizens of neighbouring Crouch End, people who live in Muswell Hill never tire of telling your how great it is. And you have to take their word for it, because let’s face it you’re never going to schlep to North London off-the-tube. (A charity visit to tubeless Bromley, maybe. But North London?!) Hence we must take the agent’s word for it that this stunning 582 sq ft one-bed loft hewn from a converted chapel is in N22 and not N.Y.C. Wrong side of the hill for £575,000 but unique – via On The Market

The Telegraph just ranked [£] Richmond upon Thames as London’s best borough, based on an unusually transparent numerical system that awarded points for everything from low crime rates to Grade I houses to green space. Then again, to visit Richmond is to want to live there. For most Londoners Richmond proper will forever be out of reach, but there are spots on the periphery that are more affordable. For example this 1,000 sq ft unmodernised cottage in East Sheen at £699,000. The makeover potential will be an opportunity for the right buyer, as will a mere 20 minutes walk to Richmond Park. But the burial ground opposite can’t be renovated away – Barnard Marcus

When I were a lad (i.e. in my 20s) brave young professionals fought over unmodernised terraces in De Beauvoir Town in Hackney – which was just as well as it toughened them up for its still-gnarly streets. Nowadays they can go for fully worked-over period pieces like this three-bedder near-ish the canal (and a big estate). With sash windows and a roomy basement kitchen with light-drenched dining area, it’s three storeys of the N1 dream – and it costs £1.65m accordingly. Sub-par transport – via Rightmove

…and away

It’s been a while since I last featured one of the seemingly inexhaustible supply of West Country stunners here on Propegator, but the wait was worth it. This seven-bedroom honey-coloured detached Georgian house in Wells is just a couple of coffee tables short of 5,000 sq ft, and every square foot looks a treat. The house has had many lives – from Victorian high society abode to restaurant to law firm – before getting a tasteful restoration into its current glory. Which in turn means you can enjoy the high ceilings, sash windows, and exposed floorboards without breaking a sweat. The garden is lavish, with water features fit for any Moroccan riad. The only downside is the (pretty) city of Wells has no train station and is a bit isolated. £1,350,000 – Inigo

Out of house

A review of the Secret Maps exhibition at the British Library – Ian Visits

Richmond woman’s £150 fine for pouring coffee down street drain revoked – Guardian

Tubedoku: an addictive new London Underground game – Time Out

Pictures of London vents looking spectacular – Londonist

The founder of Soho House is opening a new hotel off the Strand – Time Out

A modernist beach house jutting out over a Scottish loch – Guardian

That City AM chart: DT now reports London on track for only 15-20k new builds in 2027, compared to 60-65k annually in 2015-20 and the target of 80k p.a. now: https://www.telegraph.co.uk/money/property/buying-selling/developers-padlock-new-builds-london-housebuilding-collapse/ That target is itself extraordinarily unambitious given both that 3.8 mn of the UK's 28.6 mn households are in London, and that the nationwide minimum target to avoid the supply situation deteriorating further is 1.5 mn new builds (over the Parliament). As a (reluctant) Lab voter with buyer's remorse now, I have to say that this is not what the much hearalded 'delivery' looks like :(

For once the DT's right. Can't go far wrong with East Sheen / Richmond Park borders if you want to be in London but, at the same time, one removed from it. Park's a bona fide oasis. 2,500 acres, all just 8 or 9 miles, via Mortlake Station, from the metropolis' heart; and which, unlike Kew, isn't unbearably blighted by planes. Given this, £700/sq ft is a relative bargain - at least compared to super prime central locations. You could pay that or even more now for areas considered 'up and coming' as recently as the 1990s. On this occasion, I think the 'old money' knows best. Like your 'why behind the when' type framing of rate cuts as not just a policy pivot, but also a structural shift tied to broader conditions: what markets expect, versus what may actually happen. After 2009 we were told every year to expect rates to rise. We ended up waiting to the end of 2021! Lower rates with modestly elevated inflation would probably suit HMT, given the national debt dilemma, and REITs are a play of sorts on that, i.e. trying to align with government interests and all with the leverage of both the REIT's own borrowings and the sector's current discounts to NAV.