Tax policy prevarication comes for the London property market

London property recap: 22 August 2025

Chancellor Rachel Reeves is repeating the same playbook that worked so well in the run-up to last year’s October Budget – at least ‘well’ from the viewpoint of a malignant foreign power who’d be pleased to see stagnating Britain struggle deeper into the mire.

I’d argue last year’s changing of the UK’s governmental guard was greeted with genuine enthusiasm or at least relief. Even by some beyond Labour’s constituency.

After a decade grinding our gears, many people could see we needed to try something different.

And on campaign Reeves had talked growth, growth, growth.

Alas, once elected there followed months of enthusiasm-sapping speculation about which of the many taxes and reliefs at her disposal Reeves might hike or slash to make the books balance.

The animal spirits died down like a pup going under at the vets.

This sorry state of affairs wasn’t foisted on the government. It was self-inflicted. Departments actively floated ideas and prevaricated over them as a way of deciding policy.

And with all this dithering they squandered the goodwill, even before they confirmed the anti-growth policies they’d finally decided upon. (Employer’s NI hikes I’m looking at you! 🙄 )

The Begbie method of policymaking

Last year it was pension and inheritance taxes and allowances.

This time, for some inexplicable reason, they’ve decided to do it again with property.

The bunfight began on Monday with The Guardian’s ‘exclusive’ report claiming that the Treasury was looking into overhauling stamp duty and council tax – funded in part through a new annual levy on properties costing more than £500,000.

But by the end of the week The Times had seemingly been bunged its own scoop [paywall] and what a doozy – a mooted end to the capital gains tax exemption on the sale of your own home.

Perhaps on property’s costing more than £1.5m. Let’s all have a wonder, shall we?

I could fill the links below with hundreds of op-eds then unleashed in the wake of these newly-minted ‘known unknowns’.

The BBC has a comprehensive round-up of the rumours, if you missed the fun.

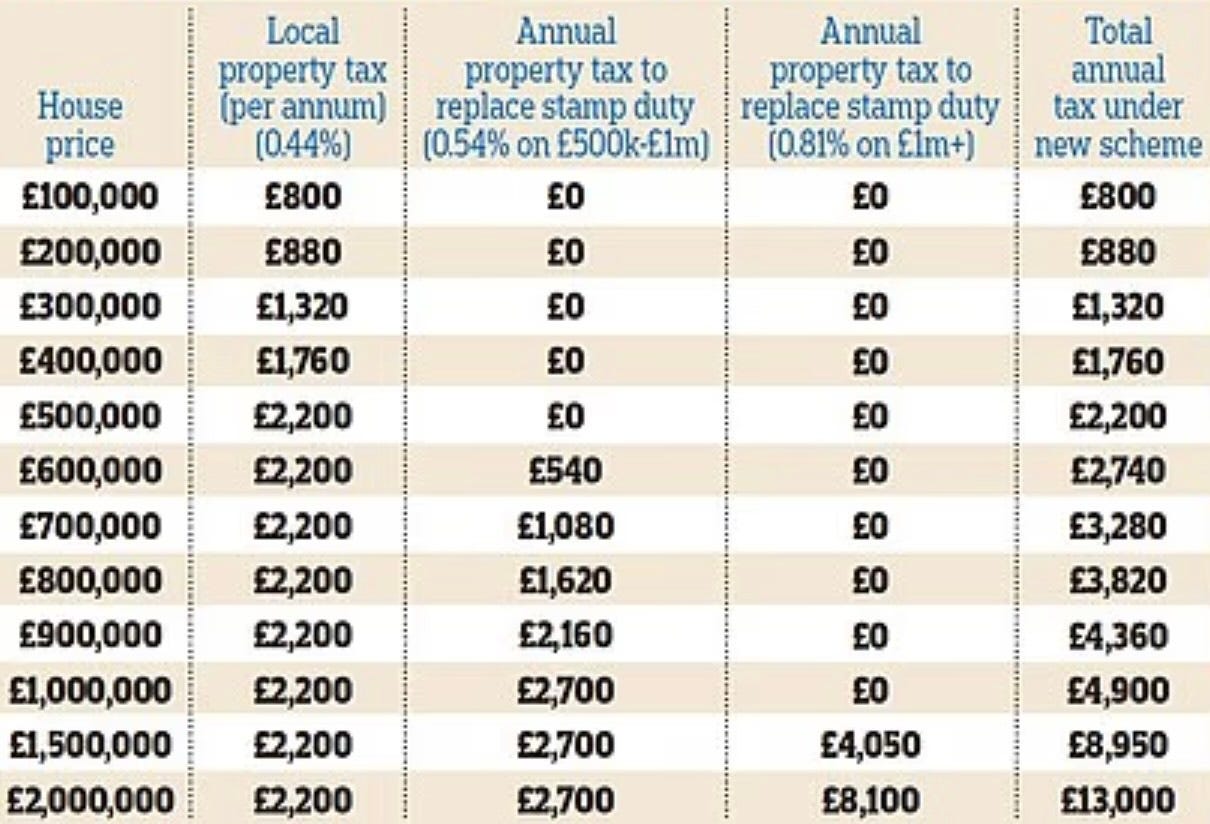

Behind its paywall The Mail even put numbers on the pain to (potentially) come:

Source: This Is Money

Meanwhile The Guardian noted that:

One proposal being considered would be to remove the longstanding capital gains tax exemption on primary residences above £1.5m, according to the Times.

Homeowners selling properties above that level would be subject to a capital gains tax at 18% for basic-rate taxpayers and 24% for higher taxpayers.

Ouch! A 24% tax payable on, say, an Islington townhouse – bought 28 years ago when Labour was last in charge and the mainstream media was at peak of its powers – could easily run into mid-six-figures. Even a veteran Guardian hack could be squirming.

Would such a tax be fair and equitable? Maybe, maybe not.

Extreme and inter-generational property inequality is at the root of many of the UK’s problems. Everyone knows the council tax system is past its sell-by date. And as for stamp duty, IMHO it’s one of the dumbest taxes you could devise, unless you actively wanted to stop people moving home.

However the rotten state of the UK property system is a bit like a patient whose disease has run too far to make it safe to operate. Tinker with any particular bit of it, and the whole thing is liable to send the beeping machine into a dreaded flatline.

What’s even worse though is sheer fear killing the property market, before you’ve even done anything. Which is just what this speculation might achieve over the next two months.

Would you buy an expensive property before the Budget, knowing that:

(a) you could be spending stamp duty that is about to be abolished

(b) fearing buying anything too pricey could put you on the hook for an annual levy

(c) perhaps both (a) and (b)?

I know I wouldn’t. Quite literally.

Paying stamp duty of £30,000 or more just to move from a flat to a terrace in London is already excuse enough to sit on one’s hands. This tax speculation seals the deal.

The UK economy cannot afford to carry this kind of unforced error, in my view. But that’s a discussion for my other blog.

Sticking here with property, if you’re enthusastic about buying in London in the face of all this then please tell me why (or why not) in the comments on Substack.

Spend safely now

Of course if you’re a first-time buyer then you might still want to crack on. All you need to do is resolve to spend less than £500,000 (ahem) – to keep your stamp duty bill as low as possible, and to dampen down any liability for that mooted annual levy.

Perhaps this nice-looking flat on the edge of Clapham Old Town fits the bill? True it’s only one bedroom, so not ideal if you’re coupled up or might get that way anytime soon. But there’s a not-too-tiny 647 sq feet on offer, albeit including a sizeable cellar. The kitchen is small but it looks functional. You even get a bit of a patio.

I know. £500,000! Which I’m sure you just happen to have on hand to bag this pretty palace… 😮💨

It shouldn’t be this way. But it is.

Just listed with Douglas & Gordon

The links

Shortcuts for the discerning property fanatic.

News

House prices in commuter towns soar, while capital sees prices slide – This Is Money

Asking prices for new build homes drop 14% year-on-year – The Negotiator

The ONS is overhauling how it calculates house price statistics – ONS

What can be done about London’s overheating homes? – BBC

Construction to start in 2026 on first part of Crossrail 2 railway – Ian Visits

Greenwich’s Art Deco town hall to become flats – BBC

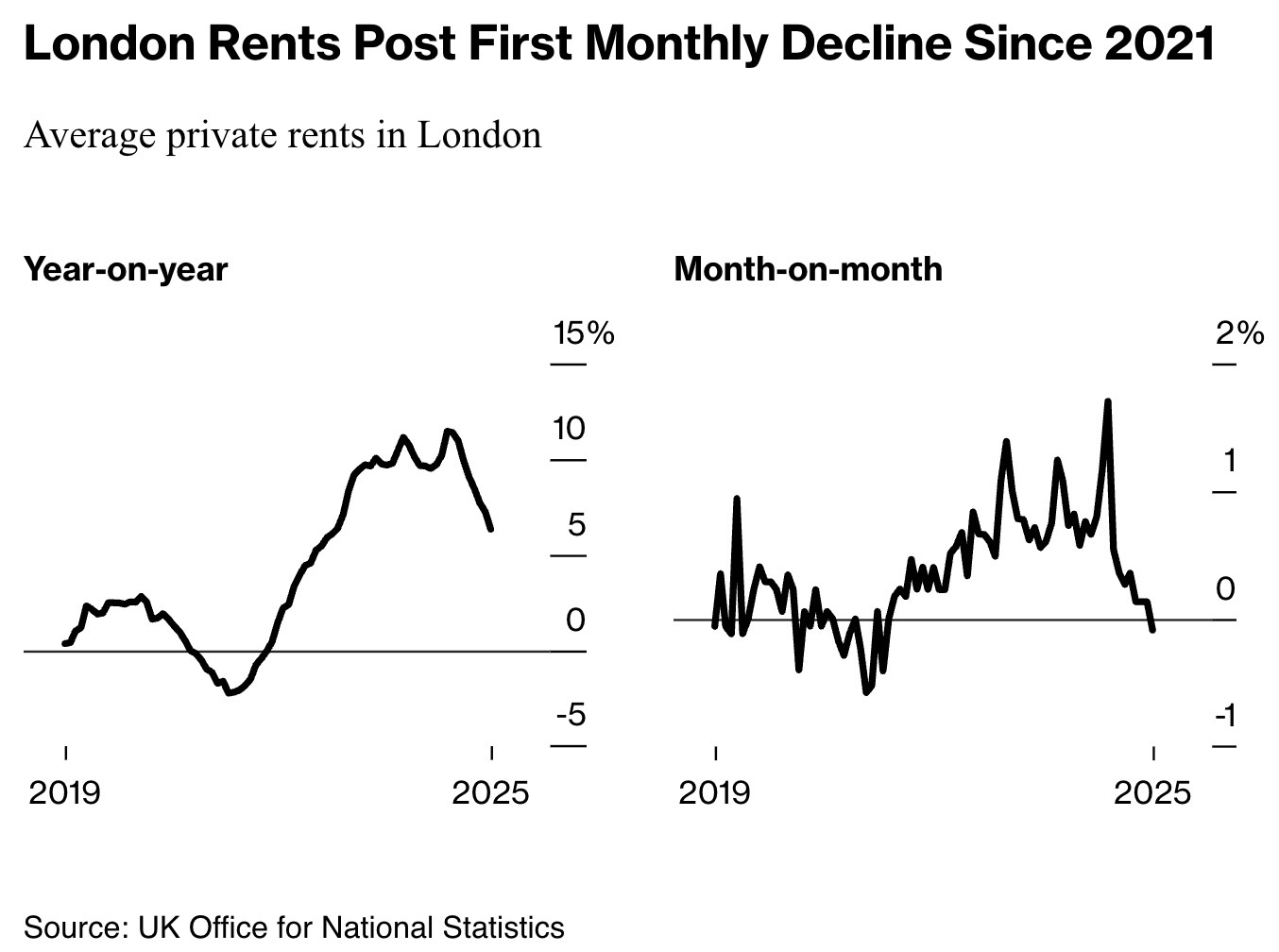

London housing rents fall for the first time since the pandemic – Bloomberg

Mortgages, moving, and other money matters

Average five-year mortgage at lowest level since 2023 – BBC

The pros and cons of fixing your mortgage for ten years – This Is Money

Renters pay 41% of income to live in London… – Standard

…while London OAPs who rent could need £833,000 to cover the cost – This Is Money

The investing angle

Deep dive into mortgage options for buy-to-let landlords – This Is Money

Built to letdown: housing supply up, rents…up? – FT

What it will take to fix London’s housing crisis… – Generation Rent

…and why aren’t empty homes being used more? – BBC

Find more investing and money insights visit our sister site Monevator

Good bones

A design duo’s London residence – The Observer

The pros and cons of knocking down walls - Ideal Home

Fewer renters than ever have a living room, and that matters – Independent

Is grey making a comeback? [Did it ever go away?] – Ideal Home

A very fancy Knightsbridge townhouse with garden-inspired interiors – Tatler

Your great outdoors

How to design a good patio - Livingetc

Chaos gardening: wild beauty, or just a mess? - The Conversation

Eight ways with water features - Homebuilding and Renovating

How to get rid of horsetail weed – Ideal Home

Property picks, home…

This two-bed near Oval is a quintessentially aspirational London flat. I don’t mean that a US rom-com fantasy of a teacher living in a Notting Hill villa. But rather, the usual slice-and-dice of a terraced house – this one with a tinge of Edinburgh’s New Town about it – but nicely done. The bedrooms are divided by a bathroom and separate loo – so sparing sharers some of the organic realities of life – and having the kitchen and reception room at opposite ends of the property gives yet more breathing space. Especially as there’s room in the elegant kitchen for a table. It costs £700,000 to live this dream, with a share of the freehold. Listen to the history podcast in the links below for some fascinating background on the area! – Harding Green

I fear Propegator might alienate the young with my fogey-ish 1990s-forged fears of deepest Hackney. But when I read an agent stating that this three-bed flat’s “elevated position makes it especially peaceful”, I can’t help thinking that flying in a helicopter above Mogadishu probably felt pretty chill, until it was struck by a rocket in Black Hawk Down. If E9 is for you a postcode of opportunity rather than the number of the first bus outta there, then know you get a generous 1,200 sq ft of modern apartment for your £850,000. And even at my most exaggerated, I can’t claim to be immune to the charms of nearby Victoria Park – The Modern House

To be snooty and a bit meta about it, Hampstead Garden suburb is really not ‘Hampstead’. But then, that’s why this Grade II-listed terrace in H. Garden Suburb’s old Artisan’s Quarter costs £900,000 and not twice as much. And it is pretty. The layout seems to make the best use of its 945 sq feet – there’s even a downstairs loo. Also, H.G.S. is peaceful. But that’s partly because you’re on the other (/wrong) side of the hill and it’s a long walk or a bus to the nearest tube at Golders Green - Inigo

This warehouse conversion in Stoke Newington still looks a bit like one. Metal girders will do that, even if you paint them white and fill the space below with mid-century furniture as the owners of this laterally expansive 2,000 sq ft loft have. Two mezzanine bedrooms at either end of the long space provide cover for a kitchen, two bathrooms, and an office area. At £1.75m the property wouldn’t be my first choice – not least because you’ll spend a lot of time on those crowded buses from Liverpool Street – but for claustrophobic millionaires it’s worth a look – The Modern House

If Blade Runner was remade but set in London (don’t laugh, we have the rain, and the increasing societal breakdown vibes) then perhaps this £5.95m oligarch-ready penthouse near Euston station could feature in the opening scenes. You know, the bit where Harrison Ford flies his car towards the massive Tyrell Corporation pyramid, flames flaring all around. Tell me you don’t see it when you look at the main photo of this three-storey monster. Dystopian, much? – Knight Frank via Rightmove

…and away

Many people dream of rose-decked cottages by a mill streams when they fantasise about leaving London. Me too. More often though I lust cheap lofts in the gentrifying provincial capitals of yesteryear. Take this warehouse conversion in Worcester, for example. Double height in places, sloping ceilings, the must-have mezzanine, 1,131 sq feet, and all for just £375,000. I concede the living space looks a cat’s cradle – Savills

Let’s face it, not the least cool thing about Frank Lloyd Wright’s Pennsylvanian masterpiece Fallingwater is the name. Well, Fellover School – a £1.65m brazenly FLW-inspired modernist home in Cornwall – can match it there, although it’s short one waterfall. There is a US-style supersized 4,000 sq ft of open space living and masses of natural light to play with, though. Also, Fellover School’s three acres runs down to a riverbank with fishing rights. Fell-in-the-water? - The Modern House

Out of house

A miniature transport-themed garden…in a tube station – Londonist

Ten of the best country hotels in Britain (that are actually in cities) – Standard

The Isle of Effra and Effra Quay open up in Vauxhall – Brixton Buzz

How Victorian London invented modern sport [Podcast] – The Rest is History

Shoreditch’s Bun House Disco recollects Hong Kong’s neon nights - Dezeen

Why is New York so different, and Moscow too? – Noahpinion / Uncharted Territories

Please don't buy that Brock St, NW1 £5.95 mn monstrosity. You see Blade Runner's iconic opening. I see the half finished builds in Sihanoukville over at the Wandering Investor: https://youtu.be/VicGQyfFcJA?feature=shared