Give me a break, says Berkeley boss

London property recap: 26 September 2025

With Labour supposedly having much-improved the planning system – at least in theory, if not yet in practice – it’s maybe not surprising to see a housebuilding industry leader such as Berkeley chairman Rob Perrins revamping his wishlist.

In a [paywalled] op-ed for The Times at the weekend, Perrins said that, actually, planning isn’t the main obstacle to building homes anymore.

No, nowadays it’s apparently the sheer expense of doing so.

As a sometime Berkeley shareholder (disclosure: including now) it’d be disingenuous for me to complain about Berkeley’s lavish cash returns to shareholders, which do suggest it managed to eek out a little more than meagre ends in putting up its ubiquitous blocks around the capital for the past 15 years.

But still, I wonder how wise it was for Perrins to remind chancellor Rachel Reeves about Berkeley’s often fat margins and healthy returns on capital.

As Jeff Bezos put it: “Your margin is my opportunity”.

I wouldn’t be surprised if the chancellor decides she feels the same way.

Speed is of the essence

As a right-of-reply, let’s hear what Perrins asks for in his editorial.

The picture may be bleak, Berkeley’s chair notes, but the situation is recoverable if we address the ‘real causes’ of the slump and so make building in London ‘viable again’:

First, the government should reform the Community Infrastructure Levy so that these funds can be spent on social housing on site. This is the best way to maximise the number of new homes that working people can afford.

Second, the government must insist that the authorities in London are realistic in their pursuit of more social housing. Private developments are the geese that lay the golden eggs of new social homes. By trying to squeeze ever larger percentages of social housing out of these projects, schemes become unviable and the supply of all new homes is choked off. What matters is maximising the absolute number of new homes being completed, both market and social, not the percentages of one or other.

Thirdly, planners and regulators need to understand that time costs money. By haggling over complex design requirements and social housing percentages and stretching out the time it takes to agree planning conditions, London authorities increase the cost and delay the completion of the homes that Londoners desperately need.

Which all sounds reasonable enough. But again, I would say that wouldn’t I?

One tip I’ll conclude with is that if Perrins should ever buy himself another chunk of Berkeley shares, it might pay to follow his lead. His disposal of £10+m worth last August was perfectly timed in retrospect, with the shares down 30% since his sale. 📉

Do you own research, of course. This is not investment advice, just a pointer of something to watch for!

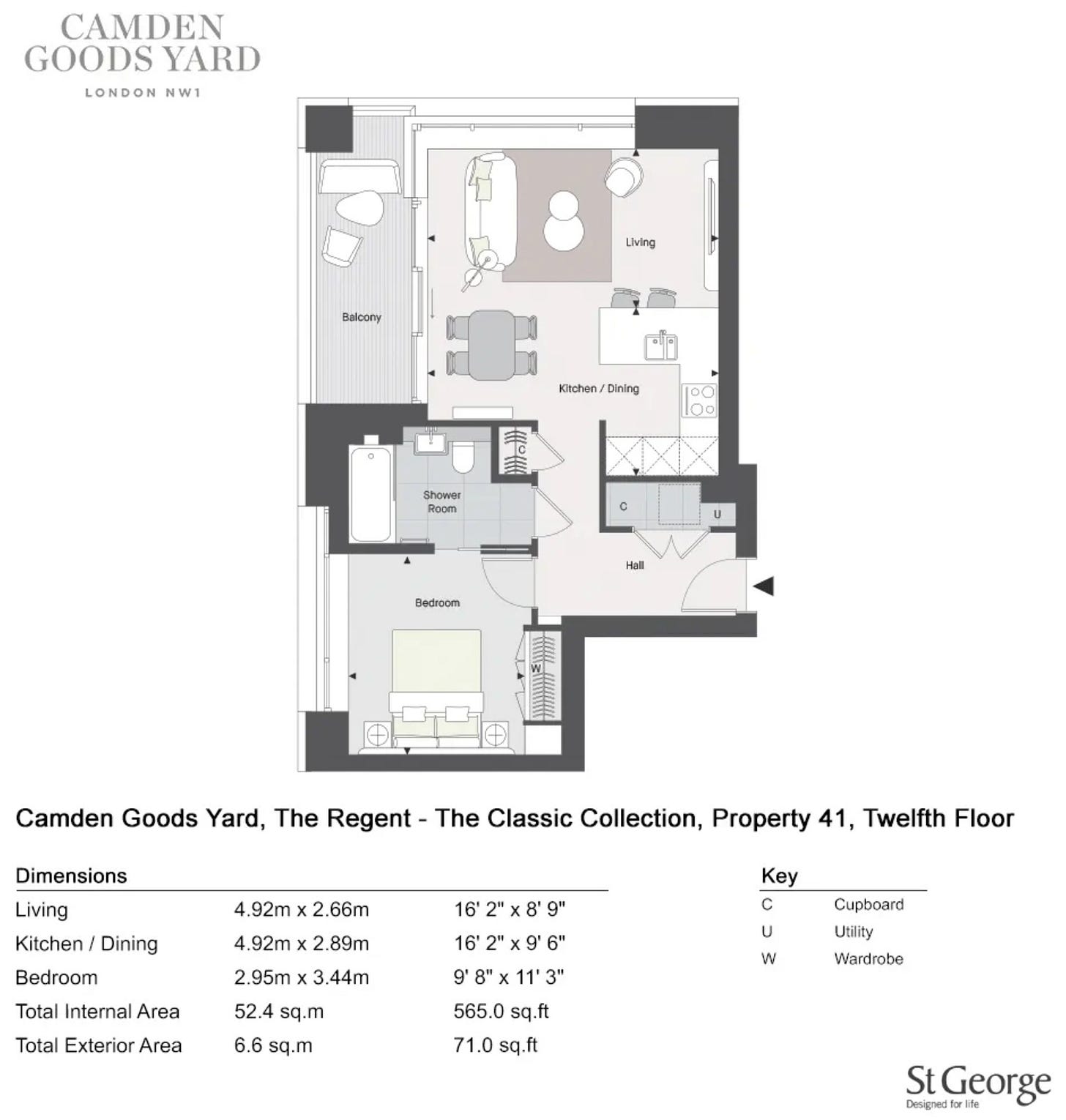

You might curb your sympathy for Berkeley when you recall it’s still got a swathe of developments on the market in London. Prices are rarely under £500,000 and easily run into seven-figures. Camden Goods Yard in – brace yourself – Camden is a textbook example of what the brownfield specialist does so well. Railway line to one side? Check. Amenities including a concierge, pool, and gym? Check. Trendy area nearby? Check, with Chalk Farm on the doorstep and the eponymous market down the road. This location must be why the cheapest flat listed is a 564 sq ft one-bed on the 12th floor for £945,000 – via Berkeley

The links

Shortcuts for the discerning property fanatic.

News

Rents fall in London as landlords struggle to sell up ahead of Renters Rights Bill – This Is Money

Prime London second-home sales plunge over 50% - Property Industry Eye

Is Britain on the verge of stagflation? - This Is Money

Almost 1.5m homes could be built on brownfield sites in England – Guardian

Buyers still willing to pay a premium to live close to a train station - This Is Money

London housebuilder Regal snapped up by UAE developer in £500m deal - Standard

Inventor’s ‘unique’ Isle of Man home sold for £15m – BBC

We need more Thamesmeads, says the chief exec of BusinessLDN – Standard

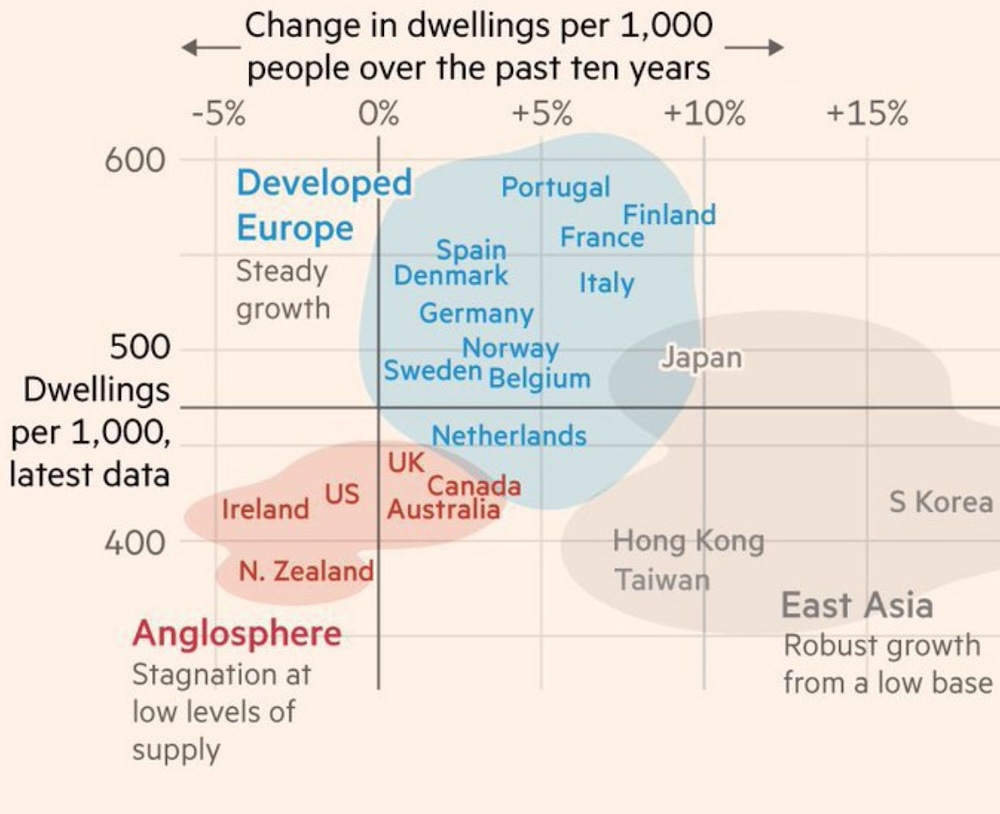

Why is the English-speaking world so bad at building homes? - Derek Thompson

Mortgages, moving, and other money matters

Barclays cuts mortgage rates for home buyers with smaller deposits - This Is Money

10 tips for buying the best homes before they appear online - Standard

Why wouldn’t a lender port a mortgage to a purchase needing renovation? - T.I.M.

What Liz Truss’s 2022 mini-budget taught us about the property market – Yahoo

“We’re selling our house. Should we rent and invest the windfall?” – This Is Money

How much can you borrow? – Be Clever With Your Cash

The investing angle

Where are house prices climbing the fastest? – This Is Money

Landlord’s misconceptions about limited company buy-to-let – Landlord Today

Five-year fixes most popular amongst re-mortgaging landlords - Mortgage Strategy

London’s ‘accidental’ landlords are a growing sub-genre [Paywall] - FT

Housebuilders should build more bungalows – This Is Money

For more investing and money insights visit our sister site Monevator

Good bones

Art as a design tool – The Spaces

How to design rooms that don’t seem overdone – House & Garden

Five steps to get your home ready for winter - Guardian

Hanging curtains to balance, blur lines, and bring impact to a room - Living Etc

Pro tips on making a living room feel extra cozy – Apartment Therapy

Your great outdoors

Cath Kidston’s former Chiswick garden is a masterclass in simplicity – Standard

Five of the best evergreen plants for borders – Ideal Home

A peak into a wild Plymouth garden – Garden Museum

Property picks, home…

Abbeville Road had already and up-and-come when I lived in Brixton in the 1990s, so it must now count as ultra-prime in desirable Clapham. This £695,000 three-bed flat is right on the strip, so to speak, but on the top floor so not too close. And there’s a roof terrace! I don’t think you can understand a London roof terrace until you’ve lived with one (as I did, bliss) or had a drunk friend fall off one (…). From the photos this decked terrace looks big and nicely fenced in, but in desperate need of a little greenery. Lovely windows and 1,100 sq ft, but it is above an (Abbeville, yah) shop – Noble Estates

This 1,268 sq ft warehouse conversion could be a versatile film set. There’s something almost Dickensian about the high wooden ceilings, first-floor barn doors, and all the bricks. Or with the right furniture and it’s an old-school Manhattan loft. Or film the exterior spiral staircase at the end of passage flanked with foliage and are we in New Orleans? Tucked into Painter’s Mews in Southwark – a gated cul-de-sac behind a terrace in what was long a try-not-to-go-there bit of south-east London, development to the west is presumably pulling the area up, though I’ve not been deep into Bermondsey for a while. £900,000 buys you this period drama - Urban Spaces

It must be 30 years since agents christened a cluster of restive tree-lined streets south of once super-sketchy Goldhawk Road as ‘Brackenbury Village’. Strolling around this now fully-gentrified locale, you can’t imagine that behind any of the front doors there still lingers crisp-packet coloured carpets or entirely unironic wallpaper. But look: this £1.25m three-bedroom terrace still awaits its modernisation makeover. Going by the particulars, it seems to be a probate. I can’t help wondering how its previous owners felt as their bit of Hammersmith became Brackenbury Village, and apparently then moved on without them – Property Solutions Group via Rightmove

…and away

Okay, so the West Country is becoming to Propegator’s ‘Away’ section what school conversions are to our London picks. But wouldn’t you consider moving from Fulham to Frome for this £1.75m six-bed beauty? Hemington House was built in 1810 and it looks every inch a Georgian from the outside. The interior though is more Bryan Johnson – much younger than you’d think, thanks to exemplary care and renovation, though still with classic bone structure. I’d love a dedicated library, and the magnolia tree in the garden is the stuff family photo albums are made of – Stowhill Estates

The great taste shift that took mid-century furniture down from the loft and out of the skips hasn’t yet transformed most of the little mid-century terraces dotted around London into homes hipsters lust after. (Honorable exceptions aside). I’m pretty sure it will though, not least because the bigger out-of-town numbers are already doing serious business. It helps that places like Klee House in Buckinghamshire look just like the US Case Study houses of the 1940s and 1950s – minus the palms and desert air. £2.2m buys you nearly 5,000 sq feet, an acre of garden, a swimming pool, and bragging rights that you were a (retro) pioneer – The Modern House

Out of house

Richmond Station has been restored to its Art Deco glory – Time Out

Tate Britain plans outdoor gardens and classroom – BBC

Ctrl Alt Deleaf train joins battle against autumn on London’s railways – Ian Visits

How this £10bn plan will transform Earls Court [Video] - CityEd via YouTube

15 instances of the London fingerposts – Londonist

Lime’s chief exec wants to see the green bikes in every London borough - Standard

How the Lovell Health House became a Hollywood icon - The Observer

I think Mr Perrins protests too much. £945,000 / 564 sq ft one bed = nearly £1,700 per sq ft. On my street (rural north east Yorkshire surrounded by the beautiful Wold etc) there's a 7 bed 3 bath property on for £950,000 / 4,700 sq ft = about £200 per sq ft. And you get plenty of outdoor space and garaging. The problem for housebuilders is making money outside London and the South East. The insured rebuild cost for my own home is more now than I paid for it just 8 years ago and ~70% of current value. Housebuilders in the North don't have the margin to build decent homes to meet supply. Social housing requirements are a red herring in London. My response to Mr Perrins' complaint is the same as the answer which Ms Mandy Rice-Davies gave in cross-examination in 1963 "well he would say that wouldn't he".