"These challenges risk bringing development in London to a complete halt"

London property recap: 19 September 2025

An early theme of this newsletter – and one also increasingly making headlines elsewhere – is that homebuilding has collapsed in London and across the UK.

Not exactly what you would have expected 18 months ago, based on Labour’s pitch to be allowed to have a go with the joypad for a bit.

But then boosting UK housing is an age-old widowmaker for politicians’ would-be grand designs. We haven’t been building enough new homes for as long as I’ve been paying attention.

Even so, the current climate is desperate.

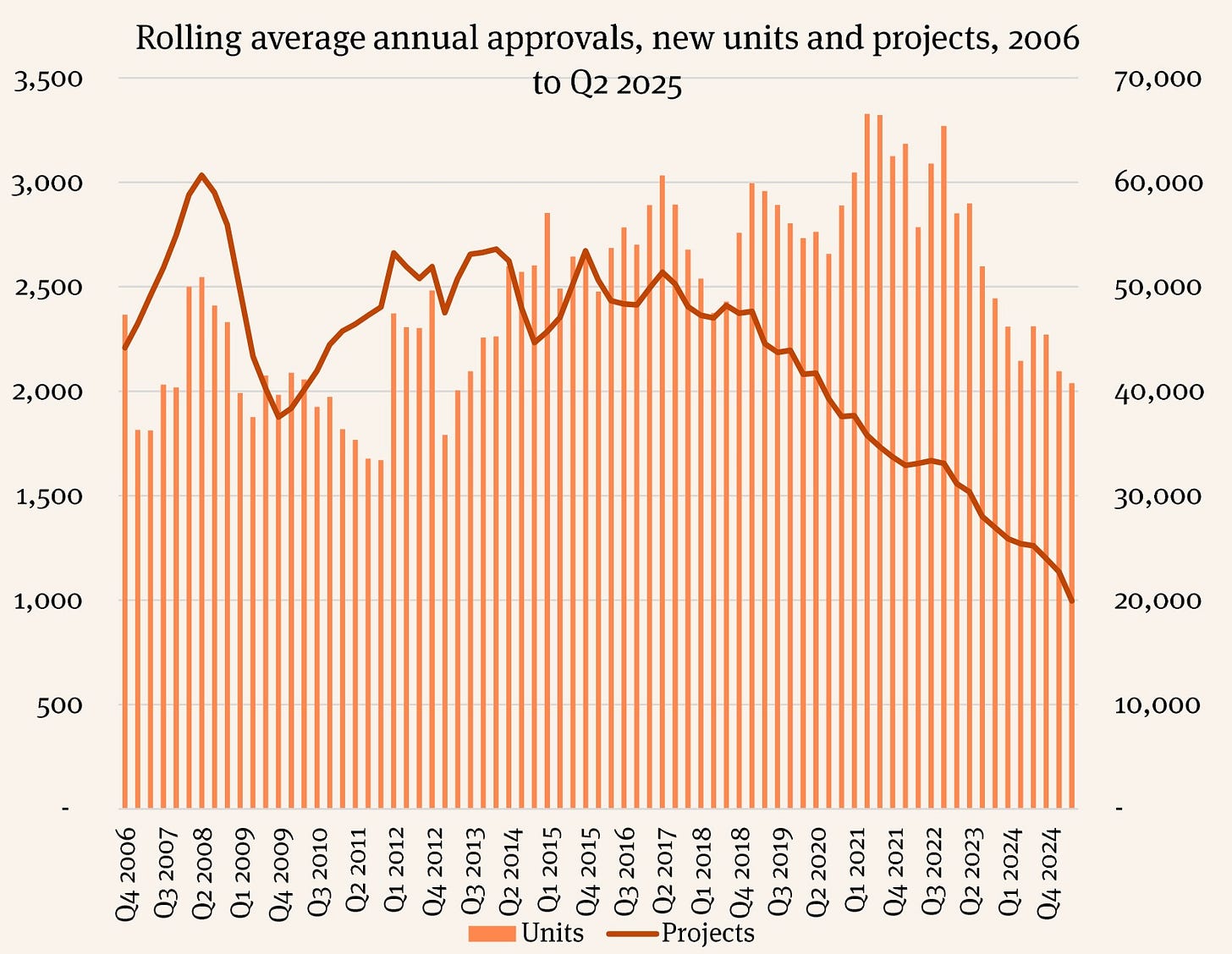

Just have a gander at this from a new report by the Home Builders Federation:

In 2023/24, the number of new homes delivered in London fell by 9% year-on-year, compared to a 5% decline in the rest of England.

A combination of issues - the Section 106 Affordable Housing market, weak effective demand from first-time buyers, pressures on viability, and planning delays - are holding up development across the country, including in the capital.

In addition, developers in London are disproportionately affected by Building Safety Regulator-related delays, recent changes to Building Regulations, increased cost burdens on brownfield development, and some of the requirements set out within the London Plan.

Collectively, these challenges risk bringing development in London to a complete halt.

Worryingly for anyone with an interest in boosting home building in the capital, numerous policy changes and taxes are being introduced by central government, including the controversial Building Safety Levy, which, because of how it is levied, will disproportionately squeeze the viability of new housing delivery in London.

There’s another 21 pages where that came from, including this damning evidence:

Does this look like the output of a confident nation rising to meet a housing crisis to you?

Hands-free steering

If you’re a regular reader of my other blog, you’ll know I think it’s zero suprise that the rot – that sloping red line – kicked in just after the 2016 Referendum.

Our departure from the EU has done nothing good for the UK. That includes homebuilding.

But seriously, it’s been nearly ten years now! Of course there was no plan as to how we’d ever replace the skilled tradespeople from the EU that we were suddenly pulling up the drawbridge on, but even without a plan we’ve had the best part of a decade to lackadaisically train up a new generation of homegrown talent.

But zip. Nada. No appetite, no capacity, and nothing like enough new homes. Just arguments about how to divvy up an ever-shrinking wealth pie and culture wars.

Go read the report [PDF] from the Home Builders Federation if you don’t believe me.

Of course some new homes are being built (though perhaps not approved for sale) because I’ve seen the scaffolding. But given the air of genteel decline the overall situation represents, let’s instead highlight a one-bedroom flat in the revamped Millbank Residences. This Grade II-listed neoclassical hulk was put up between 1927 and 1929, just a stone’s throw from Westminster. Those were the days, eh? Now a new one-bed ground flat costs £1m (after a £100,000 price cut). Not bad for 705 sq ft, amenities, and a five-minute walk to Big Ben 🎩 - Savills via Rightmove

The links

Shortcuts for the discerning property fanatic.

News

Rachel Reeves considers staggered stamp duty payments to boost housing - City AM

Meanwhile over half of Londoners would be hit by her mooted property tax – Standard

House price forecasts slashed by upmarket estate agent – This Is Money

Government urged to green-light £1.7bn DLR extension to Thamesmead - Standard

People spend £163,047 on average on rent before they buy - This Is Money

The three safest (and three most dangerous) places to live in London - Time Out

Hammersmith & Fulham Council to introduce facial recognition CCTV – BBC

These 2,300 new homes in Brentford could get a new train station, too - Time Out

Eden Project architect Sir Nicholas Grimshaw dies – BBC

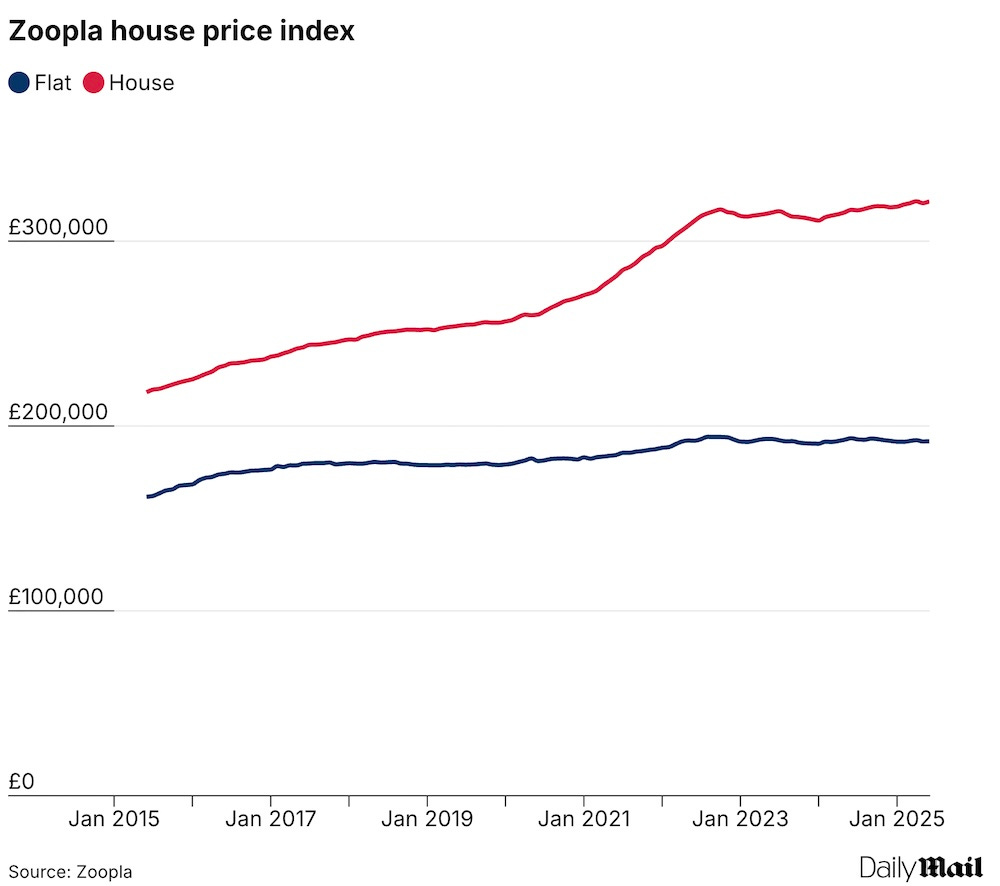

Why have buyers fallen out of love with leasehold flats? – This Is Money

Mortgages, moving, and other money matters

Nationwide cuts mortgage rates despite BoE keeping rates on hold – This Is Money

First-time buyers using mega mortgages to buy ‘forever home’ – This Is Money

Failed house sales cost UK economy at least £1.5bn a year - Yahoo Finance

Mortgage brokers steer clients to two-year fixes for personal gain, claims whistleblower – This Is Money

Find more investing and money insights visit our sister site Monevator

The investing angle

Tax strategies property investors should be using [Podcast] – The Property Podcast

“I’ve sold my flat before Renters’ Rights Bill becomes law” – BBC

How to invest under UK’s new property fault line - Landlord Today

Good bones

The design style from 1900 that’s suddenly cool again – House Beautiful

Ditch cupboard handles in small kitchens to save space – Apartment Therapy

These colours will make a living room look more expensive – Homes and Gardens

Design lessons from an old Victorian school in Marylebone – The Observer

Imaginative ways to decorate the hallway of a Victorian terrace – House and Garden

Your great outdoors

Easy planting tips for beginners – Middle-sized garden blog

The best ways to clean your gutters – Which

Property picks, home…

Wait, how long was I asleep for? Five years? Twenty? You wouldn’t believe the things I dreamed of! Mobile phones that look like tiny TVs. Peckham all trendy. That Trump guy becoming President. Anyway I’m pleased to see you can still get a loft apartment for £375,000, just like when I went under. I mean if it really was far-flung 2025 then I’d wonder what the catch was here. It’s a fine size: 900 sq ft. It’s in Forest Gate, which, okay, but it isn’t Peckham in 1995. There’s lots of natural light, and industrial signage on the walls of what’s a converted sweet factory. Run don’t walk! – The Modern House

This cute three storey mews in South Ken has been on the market since late July. It still hasn’t had its price cut. And indeed it’s a sign of the times that £1 short of £1.5m seems fair enough for such a 961 sq ft jewel. True, one of the bedrooms would be better deployed to hold the owner’s Prada and Miu Miu collection – or maybe a WFH desk – rather than a double bed, but again this is Kensington. I’ve a contrary opinion that we’re close to the bottom here. You might well pay over £1m for about the same size in Bow or Chiswick, say, and in much worse condition too – Strutt & Parker

I try not to make Propegator a backdoor to The Modern House, but then this £3.45m 3586 sq ft doozy turns up and I’ve no choice but to feature the site a second time. I’m tempted to repeat my dreaming skit, too, because when have you ever seen a place like this and been sure that you were conscious? A corten steel clad exterior with a huge glass box looming atop like the eye of a Cyclops gives way to curvy interiors, of the sort you’d find in the best upmarket 1970s libraries if they’d ever actually been built. Oh and don’t get me started on the lovely tree growing in the lower-ground internal courtyard. It sounds weird but looks so liveable. There’s solar and air-con and how it crash landed in this villagey bit of South London I’ve no idea – The Modern House

…and away

Up in York, developer Latimer has turned a vast red-brick chocolate factory built by Joseph Rowntree in the 1890s into stylish apartments. Dubbed The Cocoa Works, the interiors have an Art Deco meets industrial vibe, with crittall windows and matt black bathroom and kitchen fittings, but also swanky herringbone flooring. Two beds from £355,000 to £452,000, with incentives offered too. There’s even a penthouse going for under £600,000. All that and not an Oompa-Loompa in sight 🍫 – The Cocoa Works

London is the best city in the world, obvs, but sometimes the seedy underbelly can get you down (and I’m not even talking about an undercooked bit of char sui on a busy day on Gerrard Street). According to recent crime stats cited in the news links above, the safest place to live in the UK is actually Sutton in London. But the second safest place? It’s Telford and Wreckin. No, me neither – and I guess it’s also literally not on the average bad un’s map. But look, you can get a 3,000 sq ft five-bed McMansion for £725,000 and honestly why not? It’s not like any of your coolest friends from Deptford or Lewisham are ever going to schlep all the way there to judge you! – Harwood

Out of house

Inside London Sculpture Week (20-28 September) - Standard

America’s unofficial party house in London 🥂 – BBC

New exhibition reveals secrets of Bank of England’s 1920’s rebuild - Ian Visits

The books that best capture the essence of London – Standard

How the former US embassy became an opulent Mayfair hotel – The Observer

Croydon’s *checks notes* festival of culture returns in October 🧐 – Londonist

This reminds me that shorting Vistry was a bit of a no-brainer when all the US investors who didn't understand the UK market thought it was going to be the next NVR (obvs I didn't do it...).

Interesting stats and links. Thank you. Whatever the (several and complex) underlying (planning and economic) causes, the immediate one is that UK homebuilders generally are in a bad way. Watkin Jones (LON: WJG) is a cautionary example of the woes in UK housing development. Like many other developers,it fell into a nasty downturn in 2023, earnings dropped from £30-45m a year to ~0 (adjusted for one-offs). Shares followed, with the market cap plummeting from >£500m for most of 2022 to <£200m by mid-2023. They then cut their dividend, forcing the dividend funds to sell out, which drove the market cap below £100m. By the time those funds had sold out, the market cap had been pushed to just £50m — for a company that had been earning £40m annually just a couple of years prior. When that happens, which banks are going to fund the business for it to take on further risks with new housing development; and what Board is going to be prepared to take those risks anyways?